Export loans are provided to overseas importers and financial institutions to support finance exports of Japanese machinery, equipment, and technology mainly to developing countries. In particular, products such as marine vessels, power generation facilities, etc. incorporate a significant amount of advanced technology, and their export is instrumental in enhancing the technological base of Japanese industries. Furthermore, Japanese shipbuilding and plant facility industries have a broad range of supporting industries, including SME producing parts and components, and thus the loans are expected to positively contribute to the business of these Japanese companies. Export loans in specific sectors are also available to developed countries.

Eligible Sectors of Export Loans in Developed Countries

- Ships

- Satellites

- Aircrafts

- Medical equipment

- Equipments that contributes to reducing greenhouse gas emissions

- Railways (high-speed, inter-city projects and projects in major cities)

- Road business

- Airports

- Ports

- Water business

- Biomass fuel production

- Renewable energy power generation

- Nuclear power generation

- Hydrogen

- Fuel ammonia

- Power transformation

- Transmission and distribution

- Highly efficient coal-fired power generation

- Coal gasification

- Carbon capture and storage (CCS)

- Highly efficient gas-fired power generation

- Smart grid

- Electricity Storage

- Development of telecommunications network

- Biopharmaceuticals

- Manufacture of chemicals that use organic substances derived from animals and plants

- Electric vehicles

- Semiconductors

- Waste incineration and waste to energy

- Development of goods and technologies irreplaceable for a stable supply of raw materials of products, etc.

- Businesses using new technology, business models, etc.

Click to jump to the relevant section.

Types of Loans

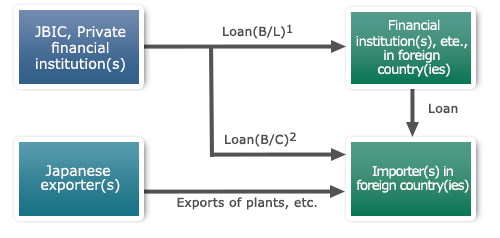

Direct Loans to Foreign Buyers and Financial Institutions (Buyer's Credit (B/C) and Bank-to-Bank Loan (B/L))

A buyer's credit (B/C) and a bank-to-bank loan (B/L) are direct loans respectively provided to a foreign importer and a foreign financial institution for financing the import of Japanese machinery and equipment or the utilization of Japanese technical services. A direct loan to an importer is called buyer's credit and to a financial institution is called a bank-to-bank loan.

2. Loan to foreign importers (buyer’s credit or “B/C”)

Cofinancing

JBIC provides loans in cofinancing with other financial institutions (usually the loan applicant's bank(s)) to meet the client's financial needs.

Loan Terms

Loan Amount

The loan amount is usually determined based on the OECD Arrangement. In principle, the loan amount should not exceed the value of an export contract or technical service contract and excludes down payment. While export loans, in principle, do not apply to local costs, such costs may be covered, fully or partially, based on the provisions of the OECD Arrangement.

Coverage

Export loans cover, in principle, 50-60% of goods and services exported. A loan applicant should make an inquiry at the relevant loan department for specific loan conditions.

Interest Rates

Interest rates are determined based on the provisions of the OECD Arrangement.

Repayment Period and Method

Loan repayment periods and methods are determined based on the OECD Arrangement. The maximum repayment period differ depending on importing countries, goods and services and contract values. Generally, the sum of principal and interest has to be repaid, in principle, in equal, semi-annual installments.

Risk Premium

Risk premium rates are determined based on the OECD Arrangement.

Security and Guarantee

JBIC assesses the creditworthiness of the borrower or the guarantor for each transaction and makes its own judgment on security or guarantee.