Summary of JBIC's Corporate Governance

Fundamental Approach to Corporate Governance

JBIC is making efforts to build corporate governance structure in conducting operations with particular attention to integrity and efficiency, as it seeks to fulfill the mission set out under the JBIC Act (Law No. 39, 2011) and realize its corporate philosophy.

Involvement of Japanese Government

As JBIC has its shares wholly owned by the Government of Japan, it is subject to the control of the Japanese government, its sole shareholder. Additionally, it is subject to the budget passed in the Diet, inspections by the Board of Audit of Japan, by the Competent Minister, and by the Financial Services Agency whose inspection is delegated by the Competent Minister.

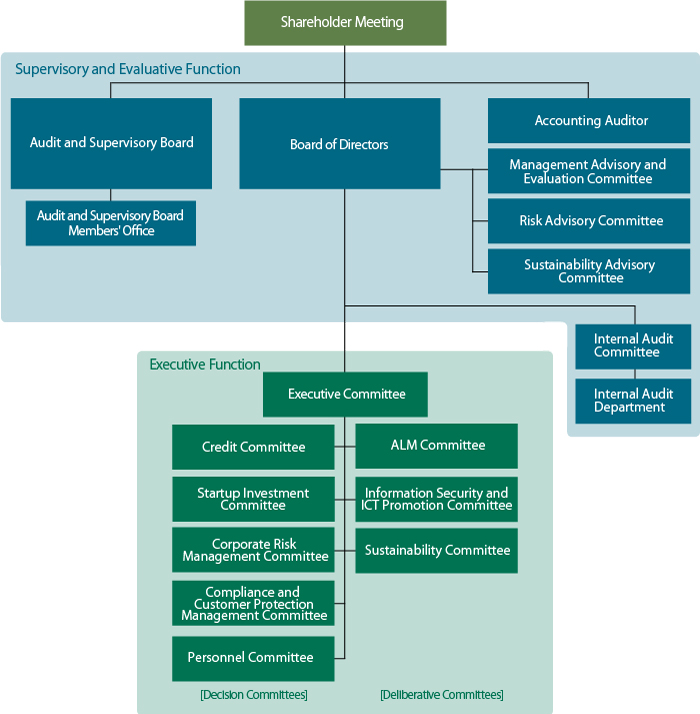

Supervisory and Evaluation Function and the Conduct of JBIC Operations

To strengthen the supervisory and evaluative function of the Board of Directors as well as conduct speedy and flexible operations, JBIC has established, in addition to the Board of Directors, the Audit and Supervisory Board and other organs required by the Companies Act, the Management Advisory and Evaluation Committee, the Risk Advisory Committee, Sustainability Advisory Committee, the Internal Audit Committee, and the Executive Committee. Furthermore, a variety of committees were set up by the Executive Committee that delegates specific tasks to them.

- Board of Directors

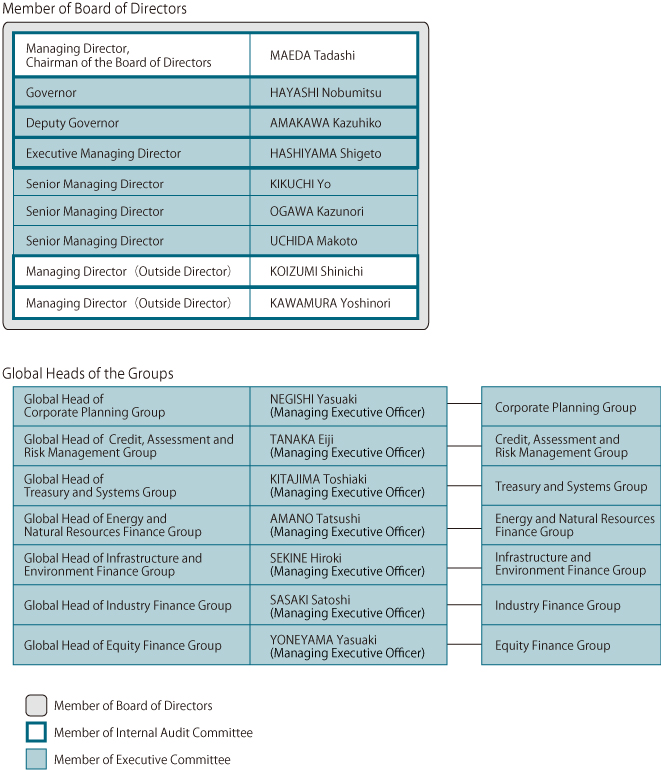

The Board of Directors consists of nine members, of which three members are non-executive directors, including two outside directors as set forth in the Companies Act. The non-executive directors supervise the conduct of representative directors and executive directors in JBIC's operations, thereby making a contribution to improving its governance. - Audit and Supervisory Board

The Audit and Supervisory Board consists of three members, of which two are outside Audit and Supervisory Board Members, as set forth in the Companies Act. Outside Audit and Supervisory Board Members contribute to improving the governance structure of JBIC, as they cooperate with the full-time Audit and Supervisory Board Member in auditing the conduct of its operations. As a section helping them execute their responsibilities, there is the Audit and Supervisory Board Members' Office. - Management Advisory and Evaluation Committee

The Management Advisory and Evaluation Committee consists of external experts, including the outside director. They make assessment and offer advice on the matters referred to them by the Board of Directors pertaining to the business operations and management of JBIC. - Risk Advisory Committee

The Risk Advisory Committee consists of external experts, including the outside director. They offer advice on the matters referred to them by the Board of Directors pertaining to risk management and assessment framework associated with large-lot obligors and risk exposure to large-scale projects. - Sustainability Advisory Committee

The Sustainability Advisory Committee consists of external experts. They offer advice on matters pertaining to JBIC’s policies to advance initiatives toward the realization of sustainability. - Internal Audit Committee

The Internal Audit Committee consists of representative directors, chairman of the board of directors and the outside director. They make decisions and deliberations concerning important matters pertaining to internal audit, as delegated by the Board of Directors. - Executive Committee

The Executive Committee consists of representative directors, executive directors, and all the managing executive officers. They make decisions and deliberations concerning important managerial matters, thereby taking responsibility for conducting flexible JBIC operations, as authorized by the Board of Directors. The committees below have been established as advisory bodies to the Executive Committee or as decision-making bodies on certain matters as authorized by the Executive Committee.- Credit Committee

The Credit Committee makes decisions and deliberations concerning important matters on loans, equity investments, and guarantees by JBIC as authorized by the Executive Committee except for those decided and deliberated by the Startup Investment Committee. - Startup Investment Committee

The Startup Investment Committee makes decisions and deliberations concerning important matters on equity investments under the Startup Investment Strategy of JBIC as authorized by the Executive Committee. - Corporate Risk Management Committee

The Corporate Risk Management Committee makes decisions and deliberations concerning important matters pertaining to the corporate risk management of JBIC as authorized by the Executive Committee. - Compliance and Customer Protection Management Committee

The Compliance and Customer Protection Management Committee makes decisions and deliberations concerning important matters pertaining to the compliance and customer protection management of JBIC as authorized by the Executive Committee. - Personnel Committee

The Personnel Committee makes decisions and deliberations concerning important matters pertaining to the personnel of JBIC as authorized by the Executive Committee. - ALM Committee

The ALM Committee makes deliberations concerning important matters pertaining to the asset-liability management (ALM) of JBIC as authorized by the Executive Committee and the Corporate Risk Management Committee. - Information Security and ICT Promotion Committee

The Information Security and ICT Promotion Committee makes deliberations concerning the use and management of JBIC's information assets, as well as important matters on information security, and cross-divisional matters on ICT, such as measures required for ICT plans and policies that have been determined by the Board of Directors and Executive Committee, as authorized by the Executive Committee. - Sustainability Committee

The Sustainability Committee, by discussing JBIC's policies, makes deliberations concerning sustainability promotion and other important measures in the field of sustainability as authorized by the Executive Committee.

- Credit Committee

Mission/Sector-Specific Group Structure

JBIC reconstituted its organization and adopted a mission/sector-specific group structure. Its objective is to strengthen the capacity to formulate projects by bringing together knowhow and expertise in each sector and area, thereby facilitating JBIC to perform the functions in its mission more flexibly and strategically.

Specifically, the Corporate Planning Group; Credit, Assessment and Risk Management Group,Treasury and Systems Group, Energy and Natural Resources Finance Group; Infrastructure and Environment Finance Group; Industry Finance Group; and Equity Finance Group were set up, with each Group having departments with special expertise.

For each Group, the responsible board member is appointed, and a managing executive officer serves as the Global Head of each Group. Each Group is managed in an integral manner under the Global Head of the Group in an effort to conduct rapid, flexible and efficient operations.

Fundamental Policy on Internal Control

Pursuant to the Companies Act, JBIC has put in place an institutional structure, including internal regulations, to ensure the proper conduct of its operations and activities, based on the Basic Policy for the Internal Control System decided by the Board of Directors.

Compliance

JBIC has set forth in its Code of Conduct to "Maintain high ethical standards and a law-abiding spirit. Observe our moral code as a JBIC member at all times." In accordance with this Code of Conduct JBIC has formulated internal regulations concerning compliance and its implementation status under the Basic Policy for the Internal Control System. In addition, the Basic Principles of Compliance is formulated as follows.

- Recognizing JBIC's role as a policy-based financial institution that undertakes international operations, directors and employees are keenly aware of the public missions and social responsibilities called for in the international community and in civil society. It is also well recognized that any act in violation of laws, regulations, or rules by its directors and employees will lead to denigrating confidence in JBIC as a whole and have a materially adverse effect on its operations. Attentive to these needs, JBIC is constantly pursuing toward compliance and operational integrity.

- Directors and employees recognize that JBIC has accountability to the general public regarding its operations and that it must make efforts to ensure the trust of the general public through appropriate information disclosure.

- JBIC shall not have any connections whatsoever with antisocial forces. It shall adopt an uncompromising attitude throughout its organization toward antisocial forces, and decisively reject all improper demands from such forces. This is essential for maintaining public trust in JBIC as well as for assuring the appropriateness and soundness of JBIC's operations and it makes appropriate responses in collaboration with police and other relevant authorities.

Compliance System

In accordance with the above Basic Principles, JBIC thoroughly engages in compliance as detailed below. JBIC makes efforts to improve compliance, primarily through the Compliance and Customer Protection Management Committee and has established the Legal Affairs and Compliance Office as an integrated compliance management unit.

Each Group and Overseas Representative Office serving as a regional headquarter has an Integrated Compliance Officer, while each department and overseas representative office has a Compliance Officer for making efforts in compliance, such as fostering such awareness among JBIC employees.

To foster an in-depth understanding of compliance, JBIC makes good use of its Compliance Manual and provides training sessions for its management and staff members. It also develops a compliance program every fiscal year as a basis for making necessary compliance arrangements and providing relevant training, and follows up on the progress and completion.

In addition to the reporting procedures in its ordinary line of business, JBIC has put in place and is properly operating an internal reporting system such that it is capable of finding significant compliance issues at an early stage and taking appropriate remedial action.

Internal Audit

As an internal control system for overall operations, JBIC has appropriate internal audit procedures to review as well as evaluate their appropriateness and effectiveness and make recommendations to improve them. For these purposes, JBIC has the Internal Audit Committee, which includes the outside director, as a decision-making body independent of the Executive Committee that is responsible for conducting operations. There is also the Internal Audit Department, independent of the line departments and directly reporting to the Governor.

The Internal Audit Department exchanges relevant information and cooperates with the Audit and Supervisory Board Members and an Accounting Auditor for executing efficient internal audit.