Feature Article TOP 10 PROMISING COUNTRIES 1

In response to heightening geopolitical risks, the trend to review supply chains is accelerating and will impact all industries.

Despite rising concerns over its future, China maintains a strong presence, with more than one-third of companies saying it is a difficult-to-replace supplier.

While nearly 50 percent of companies are engaging in independent efforts to address price hikes, such as automating the manufacturing process, about 70 percent of companies are passing on the higher costs to customers.

“We analyze trends not as dots, but lines and, at times, planes," says ITAGAKI Shinichi of the Strategic Research Department, Corporate Planning Group, who leads the team for the Survey Report on Overseas Business Operations by Japanese Manufacturing Companies conducted by the Japan Bank for International Cooperation (JBIC).

The survey, which started in 1989, is based on quantifying the results of questionnaires sent to companies, but that alone will not provide a full picture. Of the more than 500 companies that responded to the questionnaire, the team visited some 30 of them to conduct detailed interviews.

If the companies contacted by e-mail or phone are included, it comes to an even larger number. Setting aside time to do such interviews gives additional depth to the survey analysis. As this is a tremendous undertaking requiring some six months from the formulation of the survey items to the compilation of the final report, requests for explanation come in from many companies after the release of the report, keeping ITAGAKI busy traveling within and outside Japan.

This fiscal year, in addition to the regular questions, including "overseas business performance," "business prospects for medium-term," and "promising countries/regions," additional topics were added such as the “shape of supply chains under fragmented global economy" and the “impact of global price hikes on business development." ITAGAKI explains some of the notable points here.

The countries in the Global South are increasing their presence, with many also ranking in the top 10 promising countries for investment. ITAGAKI Shinichi says that JBIC wishes to support Japanese companies in developing operations in these countries’ growth areas and finding solutions to their social challenges.

Though this had been recognized for over five years now as a common challenge facing companies expanding operations overseas, its importance has been underlined by the Russian invasion of Ukraine, along with the ongoing U.S.-China conflict.

However, forming dual track supply chains is no easy matter for companies. Making changes to contracts is not something that can be done immediately, as negotiations usually take six months to a year. Nevertheless, following the impacts of the Ukraine invasion, 40 percent of companies, particularly large enterprises, reviewed their procurement sources for raw materials, indicating a shift beyond addressing short-term impacts.

Through history, there have always been countries and regions afflicted by political instability, such as the Middle East. Geopolitical risks, once limited, are now impacting global supply chains, and can no longer be ignored by any industry.

The possibility of the Israel-Gaza conflict, which broke out last year, spreading to neighboring countries demands vigilance. As for upcoming impacts, 2024 is an "election year," with national elections taking place in more than 40 countries. These include nations ranking high in the survey as "promising countries for business development in the medium-term (the next three years)": India (1st), the U.S. (4th), Indonesia (5th), and Mexico (7th). In this sense, geopolitical risks are increasing in many countries and regions.

In this survey, more than half of companies with operation bases in China responded that they are concerned. While only about 1 percent reported feeling direct impacts, a very large number are concerned about China’s trajectory, likely having a negative impact on their future business activities. However, China still has a strong presence in the market, with more than one-third of the companies citing it as a difficult-to-replace supplier of raw materials, parts, and manufacturing equipment.

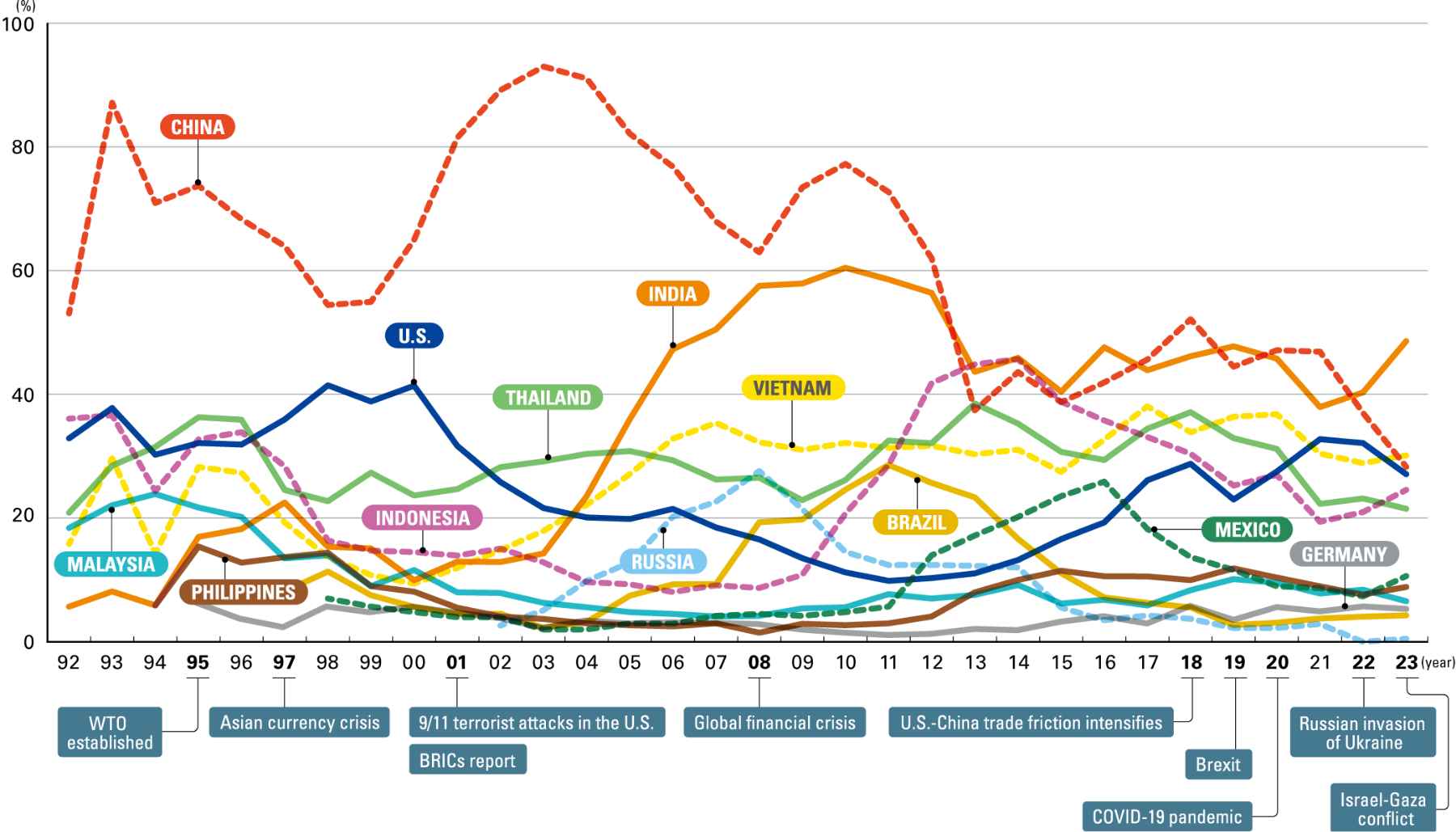

Respondent companies listed up to five countries they considered promising for business development in the medium term (the next three years), and these were ranked as promising companies.

Nearly 50 percent of the companies are working to reduce energy use at their own facilities, and are taking measures such as reducing labor costs by automation of manufacturing and introducing IoT and DX to streamline operations. However, there are limits to such initiatives, and about 70 percent of companies have passed on price increases. It seems that the more a company is affected by external factors, such as the chemical manufacturers I just mentioned, the more ready they are to pass on price hikes.

Director

Division 1, Strategic Research Department

Corporate Planning Group, JBIC

ITAGAKI Shinichi

Joined JBIC in 2002. After assignments including the Representative Office in New York, the Country Credit Department, the Strategic Research Department, and the secondment to Cabinet Secretariat, he assumed his current post in 2023. Graduate of the Faculty of Economics, Kyoto University (BA). Graduate of Sanford School of Public Policy, Duke University (MA).

Overseas Business Operations