JBIC STORY

Sovereign credit ratings, which assess the creditworthiness of foreign governments, are crucial to JBIC’s loan decisions. They also support Japanese companies by providing information on the political and economic climate and insights on a country. MATSUURA Miki shares the backstory of the Country Credit Department’s sovereign ratings and information provision.

Division 3 and Credit Rating and Planning Division, Country Credit Department,

Credit, Assessment and Risk Management Group, JBIC

MATSUURA Miki

Joined JBIC in 2023. Responsible for assessing and monitoring the macroeconomic conditions of countries in the Middle East and Africa. He has conducted fact-finding missions to Angola, Tanzania, Senegal, Côte d’Ivoire, Egypt, the United Arab Emirates, and France. Holds a master’s degree from the University of Tokyo’s Graduate School of Public Policy.

More than 50 economic and financial indicators used to analyze sovereign risk

“Sovereign credit rating is an assessment of the repayment capability of a country, and if a loan is granted, whether it can be reliably expected to pay back the funds it borrows,” explains MATSUURA Miki of JBIC’s Country Credit Department. “Sovereign” is another word for “state,” making sovereign credit rating an assessment of the creditworthiness of a country to which JBIC extends loans.

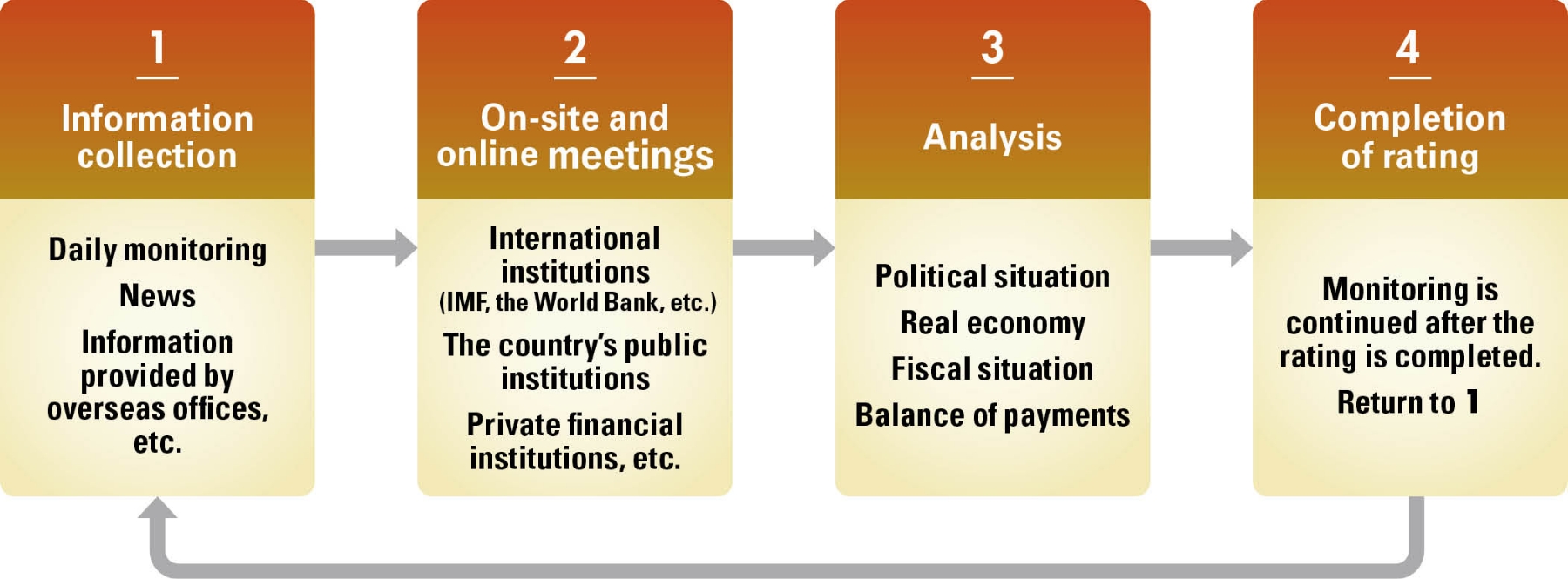

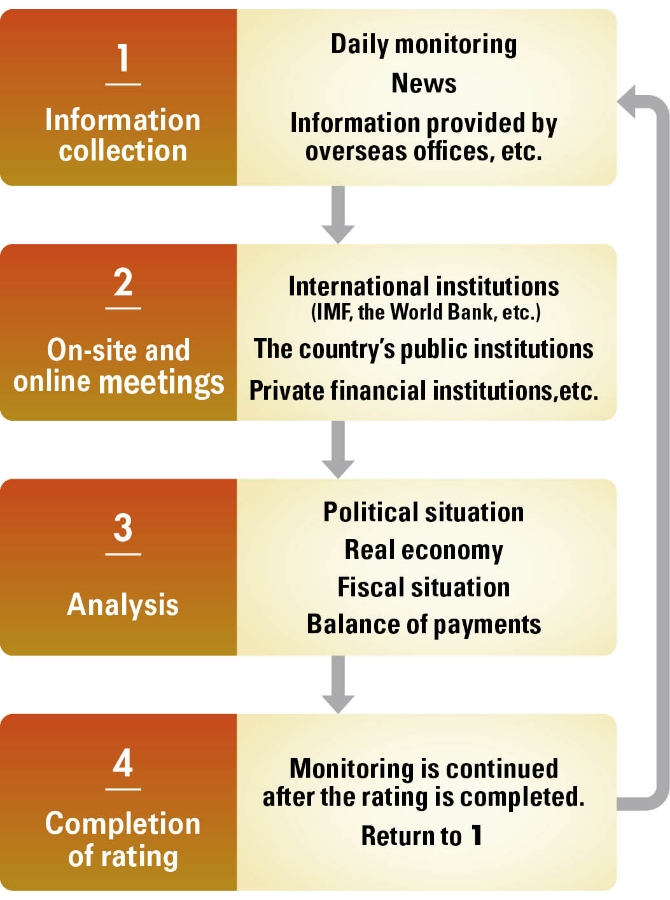

MATSUURA has been responsible for about 15 countries and local governments in Africa and the Middle East, evaluating and monitoring their political and economic climates. More than 50 economic and financial indicators are analyzed for a sovereign credit rating, including GDP growth, fiscal and trade balances, as well as outstanding public debt. Through these analyses, he discerns the country’s capability to repay foreign currency-denominated debt. In addition to quantitative analyses, he constantly reviews reports from international news agencies and local media, as well as publications by international and domestic research institutions.

MATSUURA, who studied economics as a student, says that he finds every day at the Country Credit Department, analyzing the creditworthiness of foreign governments and other entities, very stimulating.

Local visits reveal determination to advance national development

Within JBIC, the members of the Country Credit Department who handle sovereign ratings are also referred to as “economists.” They not only conduct regular monitoring but also carry out in-country reviews when a project requires detailed checks to approve financing. There they meet with government officials, economists from international financial institutions such as the International Monetary Fund and the World Bank, as well as local Japanese companies, to gather information and engage in discussions.

MATSUURA visited Angola, one of the countries he was responsible for, last year to assess its economic growth prospects following a long civil war. He had meetings at about 25 locations, but the one that stood out was when a ministry official stated confidently: “We will open the country to the outside world and spur growth by leveraging investment and trade within the global economy.” MATSUURA recalls being impressed by the policymaker’s strong determination to place the country on a growth trajectory.

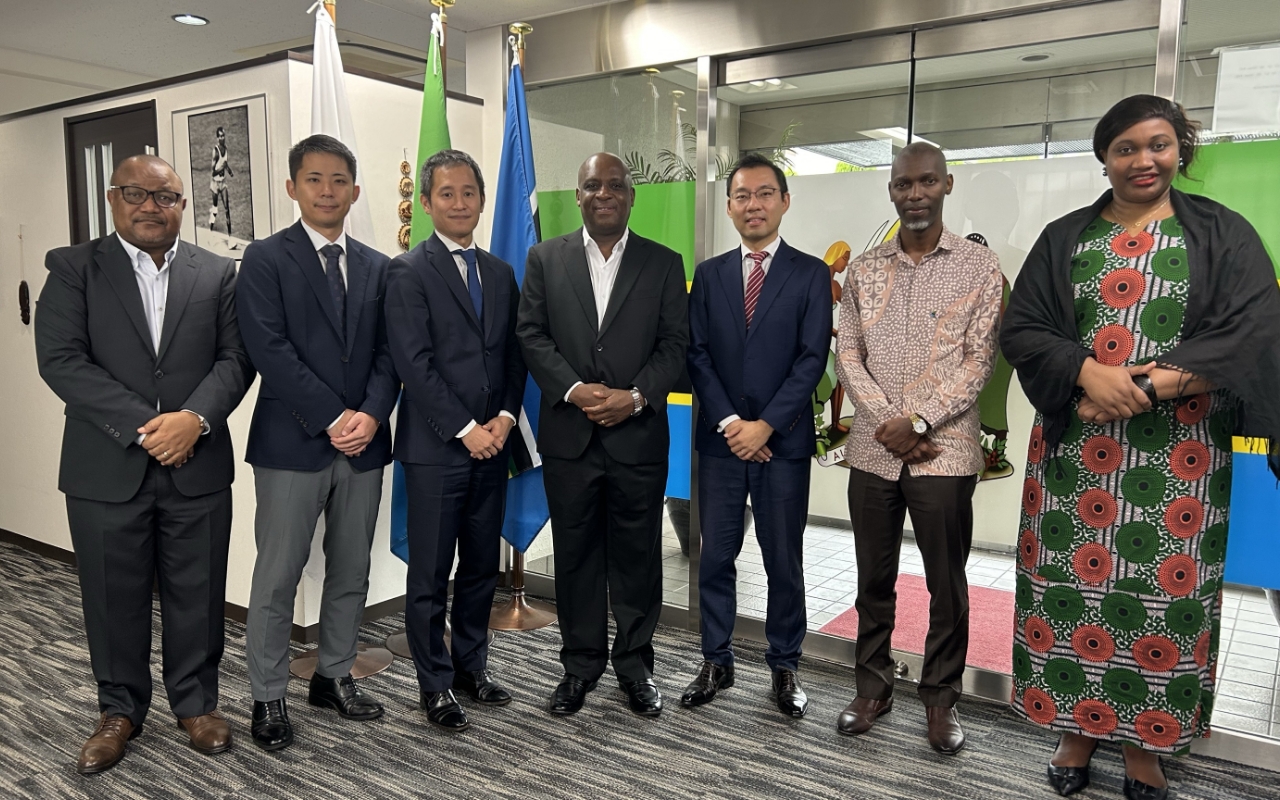

During a visit to Tanzania, he had the opportunity to discuss the country’s monetary policy with the deputy governor of its central bank. “To discuss with someone at the heart of a country’s macroeconomic policy was extremely stimulating. In moments like this, I sense the true thrill of my work in sovereign credit ratings,” he notes enthusiastically.

In May this year, MATSUURA also worked on a financing project with the government of Côte d’Ivoire under Global action for Reconciling Economic growth and ENvironmental preservation (GREEN) operations. This was JBIC’s first loan to Côte d’Ivoire. This project was promoted in close collaboration with the JBIC Representative Office in Paris, including meetings with government officials in Côte d’Ivoire. The country was highly rated for its steady economic growth, policy management capabilities, and its political and macroeconomic stability. “We consider this loan to be very significant from the perspective of advancing efforts for global environmental conservation in Côte d’Ivoire,” explains MATSUURA.

Hearing the views of embassies in Japan is also essential. Here he met with the ambassador and other officials at the Embassy of the United Republic of Tanzania in Japan.

Supporting Japanese businesses through risk insights

Information and insights about political and economic conditions obtained through sovereign risk assessments are not exclusively for JBIC, but are provided to Japanese companies to support their overseas business development. By providing insights on a country’s macroeconomic outlook, risks, and policy trends, JBIC aims to help Japanese companies to identify opportunities and make informed decisions on operations.

MATSUURA previously made an individual visit to a Japanese company that was thinking about expanding into Tunisia to brief it on the situation there. “Because of the limited information available on the country, I believe the meeting allowed the company to gain a proper understanding of the key points it needs to consider for expanding operations there,” he says, noting how valuable he felt the meeting was.

JBIC conducts operations in countries around the world, but no two are the same. Thus, JBIC’s economists are expected to have deep, specialized knowledge about the regions and countries they cover. On the other hand, JBIC’s Country Credit Department has the advantage of being able to conduct inter-country comparisons. Economists responsible for different countries come together to engage in free and open discussions, allowing for timely multifaceted analyses. These include how global macroeconomic and geopolitical risks impact a country, or how outlooks shift for nations heavily dependent on commodity exports.

MATSUURA, who studied economics at university and wanted to work in foreign government ratings even before joining the bank, says that his current role intensified his interest in international politics and economic trends. “While gaining valuable experience through my current work, I want to work on projects in collaboration with Japanese companies that align with the growth strategies and industrial policies of partner countries to help solve the challenges they face,” he says, with his eyes set firmly on the future.

MATSUURA Miki, Division 3 and Credit Rating and Planning Division, Country Credit Department, Credit, Assessment and Risk Management Group, JBIC

The Country Credit Department analyzes and assesses the sovereign risk of foreign governments (foreign government credit risk) and other entities. It is responsible for the ratings that are indispensable to providing long-term credit support for overseas projects, centering on those in emerging countries. Economists with various expertise in economic and financial matters and their respective regions monitor countries around the world.