Seven JBIC “Global South” Projects

Through financing provided to local Indian banks, JBIC indirectly supported Japanese automakers and construction equipment manufacturers there. YONEYAMA Satoru explains the situation around lending in the infrastructure sector in India, a country that has its sights on becoming the “factory of the world.”

Environmental pollution regulations are progressing in India, and it is expected that demand for eco-friendly automobiles will also expand.

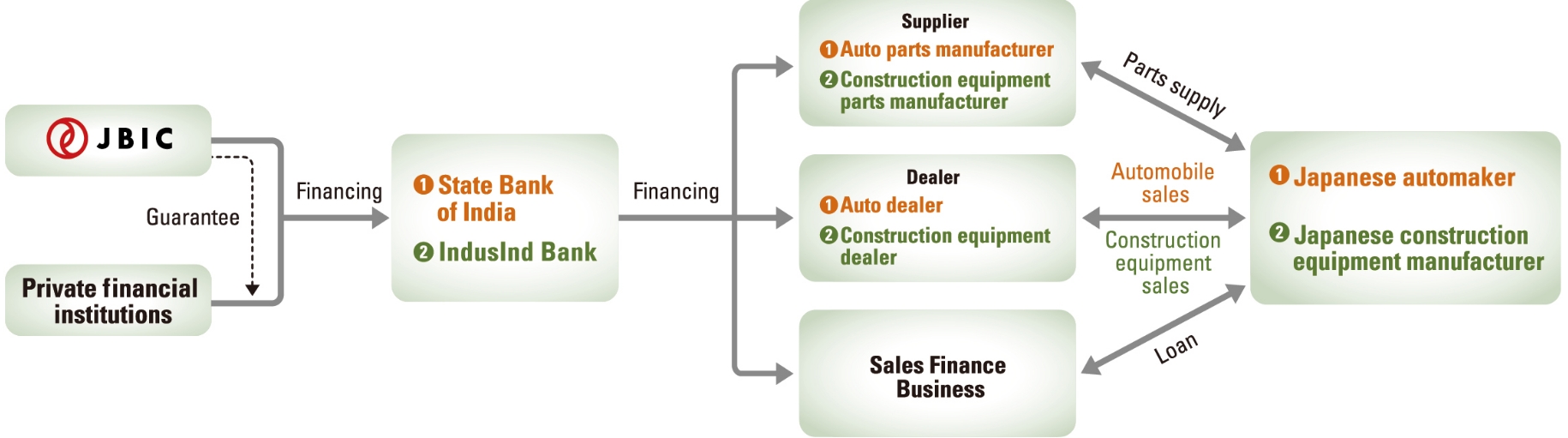

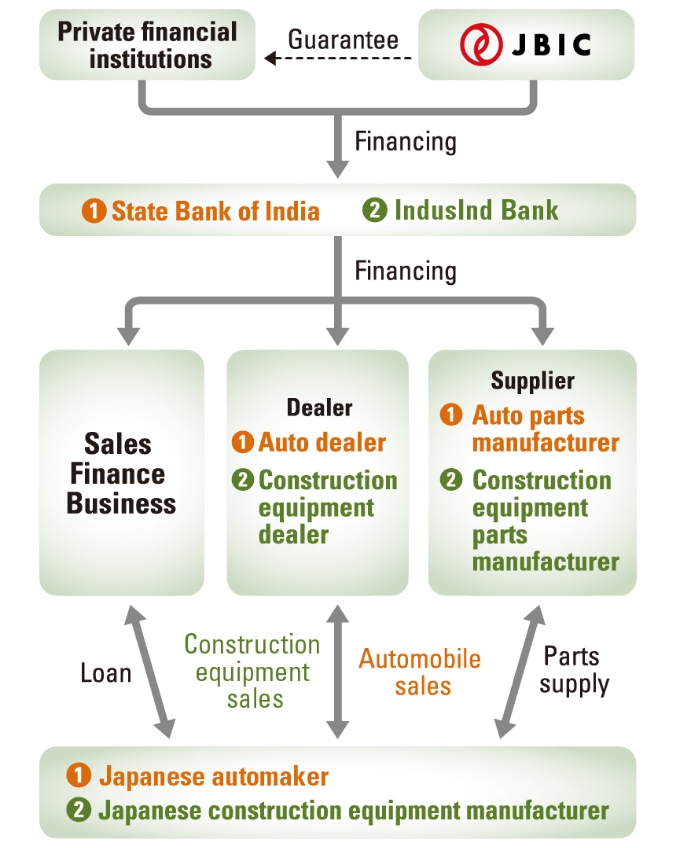

Indirect support to Japanese-affiliated manufacturers for supply chain resilience

India’s reputation as an IT powerhouse is well-established, but its manufacturing industry and government investments in infrastructure are also attracting increased attention recently. India’s economy grew by 8.2% in 2023, and many companies have high expectations for its future prospects.

In March 2021, a loan agreement for up to USD600 million (JBIC portion) was signed with the State Bank of India to provide necessary funding to the local supply chains of Japanese automakers. Similarly, in March 2023, a loan agreement for up to USD60 million (JBIC portion) was signed with IndusInd Bank Limited to support Japanese construction equipment manufacturers.

India’s national infrastructure development plan, which aims to improve logistics networks, earmarks a total of INR100 trillion for infrastructure projects. YONEYAMA Satoru and his team at the Infrastructure and Environment Finance Group noted this and identified opportunities in the construction machinery sector.

“The Indian construction equipment market is the third largest in the world in terms of units sold,” explains YONEYAMA. “Notably, Japanese affiliates hold about a 60 percent share of the Indian market for excavators, with high growth prospects.”

Case 1: Automobiles/Case 2: Construction equipment

Under its “Make in India” policy, the government has been calling for direct investments in India’s manufacturing industry to make the country the “factory of the world.” Against this backdrop, these two financing projects provide indirect support to Japanese automakers and construction equipment manufacturers while also benefiting Japanese affiliates taking on risks in India, their local suppliers, and Indian banks.

“JBIC is uniquely positioned to design projects that benefit not only Japan but also partner countries and companies,” remarks YONEYAMA. This is what makes this job so rewarding. This initiative that fosters partnerships between Japanese affiliates and Indian companies serves as a true bridge between the Global South and Japan.

Director, Division 2

Social Infrastructure Finance Department

Infrastructure and Environment Finance Group

YONEYAMA Satoru

Joined the bank in 2001. Assumed his current position in 2022 after assignments including the International Finance Department I (in charge of China), secondment to the Inter-American Investment Corporation (IIC), Human Resources Management Office, and the Corporate Finance Department (engaged in M&A support, etc.). Graduated from Keio University, Faculty of Law, and University of Southern California, School of Law.