PROJECT FRONTLINE Supporting supply chain resilience enhancement for Japanese manufacturers in India

JBIC indirectly supported Japanese automakers and construction equipment manufacturers in India through loans to local banks. YONEYAMA Satoru shares the story of the two projects and the negotiation skills cultivated.

Director, Division 2, Social Infrastructure Finance Department, Infrastructure and Environment Finance Group

YONEYAMA Satoru

Joined the bank in 2001. Assumed his current position in 2022 after assignments including the International Finance Department I (in charge of China), secondment to the Inter-American Investment Corporation (IIC), Human Resources Management Office, and the Corporate Finance Department (engaged in M&A support, etc.). Graduated from Keio University, Faculty of Law, and University of Southern California, School of Law.

Indian-style negotiation skills cultivated within JBIC proved their worth

Tough negotiations come with the territory for projects in India, where driving a hard bargain is ingrained in the culture. India also tends to be rank conscious, explains YONEYAMA Satoru of JBIC’s Infrastructure and Environment Finance Group.

He says, “This makes it important to discern when to take the negotiations from the working level to the management level. We worked closely with the JBIC Representative Office in New Delhi to make sure this point was covered.” So bringing higher-ranking personnel to the negotiating table can break deadlocked talks.

Another negotiation art is setting up meetings at crucial junctures. “Progress is sluggish if only email or other such forms of communication are used, so you need to set up meetings. Although some meetings were held online, there was a period when almost every month somebody from our team traveled to Mumbai to keep the negotiations going,” according to YONEYAMA.

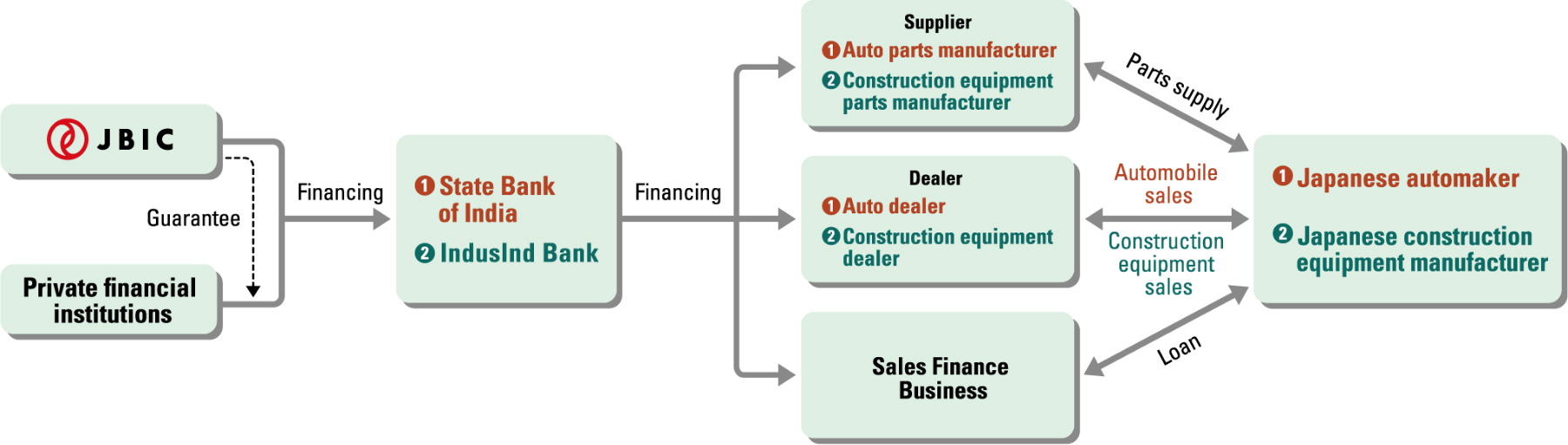

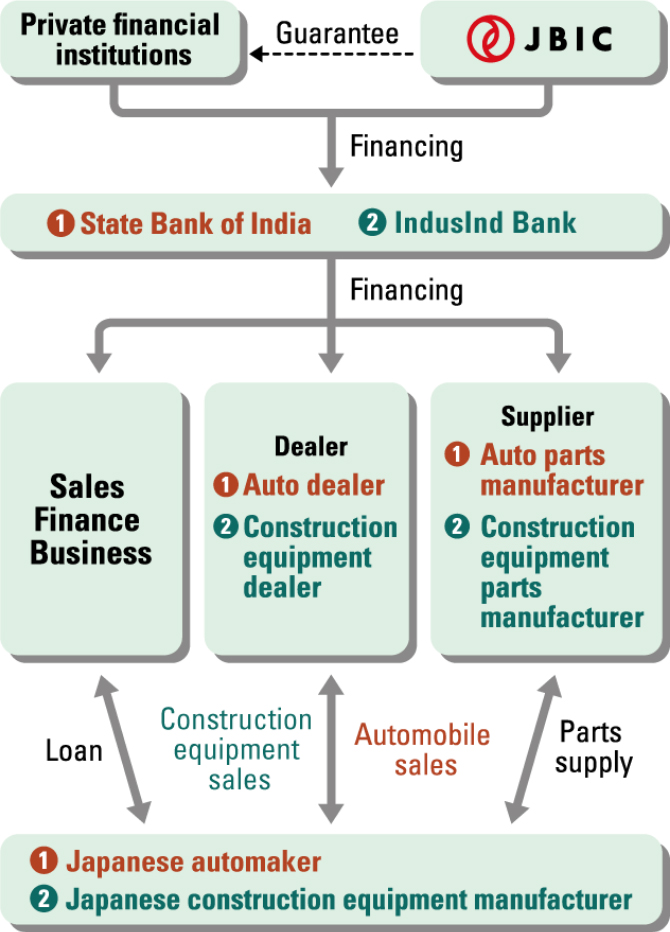

In March 2021, JBIC announced a loan to support for enhancing the supply chain resilience of Japanese automakers in India, announcing the same for Japanese construction equipment manufacturers in the country in April 2023. Both are two-step loans provided through Indian banks to the suppliers and dealers of Japanese affiliates, as well as sales finance businesses for the purchase of the Japanese affiliates’ products. Indian-style negotiation skills, cultivated within JBIC, proved their worth here.

Two-step loan for indirect support

to

Japanese-affiliated

manufacturers

Case 1: Automobiles / Case 2: Construction equipment

For the banks and for manufacturers, a two-front strategy differing from regular loans

In these two projects, which did not directly involve the Japanese companies, JBIC played a pivotal role in direct negotiations with Indian banks, while also simultaneously advancing discussions with the Japanese affiliates—a challenging, two-front strategy.

For the Indian banks, JBIC researched and selected which had strong capabilities in the sectors to be supported, and negotiated terms and conditions while explaining the loan scheme, which would also support local parts manufacturers. With regard to the manufacturers, the significance of providing indirect support to Japanese companies was explained, and discussions were conducted to narrow down the list of local suppliers that should be eligible for loans.

“As JBIC is entrusted with the mission of enhancing the international competitiveness of Japan’s manufacturing industry, in order to make this scheme one that would benefit Japanese affiliates, we visited them to explain the significance of supporting local suppliers. We consequently gained their support in establishing this loan scheme.”

An easy-to-understand explanation of the features of the loan scheme was provided by YONEYAMA Satoru, Director, Division 2, Social Infrastructure Finance Department, Infrastructure and Environment Finance Group, JBIC.

India’s reputation as an IT powerhouse is well-established, but its manufacturing industry and government investments in infrastructure are also attracting increased attention recently. India’s economy grew by 6.7 percent in 2022, and many companies have an expectation about its prospects. This is reflected in the JBIC Survey Report on Overseas Business Operations by Japanese Manufacturing Companies, where India ranked top for two consecutive years as a promising country for medium-term business expansion.

In the 2021 support for enhancement of supply chain resilience of Japanese-affiliated automakers, a loan agreement for up to USD600 million (JBIC portion) was signed with the State Bank of India. In addition to supporting Japanese automakers in India, who were suffering from the impact of the COVID-19 pandemic, this scheme also aimed to support the manufacture and sales of eco-friendly vehicles.

“The Indian government has been introducing fuel economy and emissions regulations since 2017 to reduce greenhouse gas emissions and resolve increasingly serious air pollution. So this project is also in line with India’s environmental protection policy,” says YONEYAMA.

The satisfaction of engaging in meaningful efforts that benefit both Japan and its partners

Why not use this same loan scheme to support Japanese companies in other sectors? This was realized through a 2023 loan agreement for up to USD60 million (JBIC portion) with IndusInd Bank Limited to support Japanese-affiliated construction equipment manufacturers. YONEYAMA and his team had taken note of India’s plans for much-needed improvements to its logistics infrastructure. Under India’s national infrastructure development plan, PM Gati Shakti, a total of INR100 trillion is earmarked for infrastructure development projects.

According to YONEYAMA, the reason for targeting the sector was that “the Indian construction equipment market is the third largest in the world in terms of units sold. Notably, Japanese affiliates hold about a 60 percent share of the Indian construction equipment market for excavators, with high growth prospects.”

Under its “Make in India” policy, the government has been calling for direct investments in India’s manufacturing industry to make the country the “factory of the world.” Against this backdrop, both Japanese affiliates taking on risks in this country and the Indian companies that supply them, as well as local banks, would feel the benefits of these two projects.

“JBIC is in a unique position to conceive projects that can benefit not only Japan but also partner countries and companies. This may be what makes this job so rewarding,” remarks YONEYAMA. Though he notes that those in charge of fast-growing India are kept extremely busy, he is already looking ahead to his next challenge.

YONEYAMA Satoru, Director, Division 2, Social Infrastructure Finance Department, Infrastructure and Environment Finance Group, JBIC

In March 2021, a syndicated loan agreement was signed with the State Bank of India amounting to up to USD1 billion (JBIC portion: USD600 million) to provide funds necessary for the local supply chains of Japanese automobile manufacturers. In March 2023, a syndicated loan agreement was signed with IndusInd Bank amounting to up to USD100 million (JBIC portion: USD60 million) to provide funds necessary for the local supply chains of Japanese construction equipment manufacturers.